- Solutions

- For Industry

- By Need

- Products

- VarbaseEnterprise CMS Distribution for Drupal

- Uber PublisherEnterprise Digital Media Platform Builder

- VardocDrupal Knowledge Base Platform

- Campaign StudioOpen Marketing Platform - by Acquia

- Open SocialSocial Business Platform - by Open Social

- Services

- Strategy

- Design

- Development

- Migration

- Support and MaintenanceSupport and Maintenance

- DevOps

- Digital Marketing

Datasheet

- Clients

- Ideas

- About

- Contact Us

Delivering Financial Services Beyond 2023

How Digital Transformation is Impacting the Financial Service Industry

The importance of customer service in the financial services industry cannot be understated. For example, how excellent service to bank customers affects their satisfaction and their choice of banking.

For banks to thrive, both product and service delivery must be adequately aligned with customer expectations: achieving customer satisfaction and loyalty is essential for long-term survival.

With the transformative disruptions that impacted the financial services industry, this is truer today than ever before. Customer service has evolved into the customer experience.

This digital transformation is impacting banks, insurers, investment solutions providers, and even stock exchanges who are realizing the importance of creating a sustainable digital experience for their clients and website visitors.

Case study: Amman Stock Exchange New Drupal 8 Site Jumps 137k places in Alexa Rank

The Need for Speed: Time For Action

The more people become financially literate and sophisticated, the more they will expect you to provide them with seamless and convenient experiences. Financial sector operators were late to the party, and sensing the opportunity to create a more convenient experience - many startups offering fintech solutions emerged.

Any recurring payment is now considered a chore and people are appreciating the convenience of one-touch fintech solutions provided by disruptive startups. Operators such as Saudi Arabia's Mada and Jordan's efawateercom are quickly being adopted and have become an integral part of anyone’s consumer banking or bill payment experience.

Even telecom operators and banks have integrated such services into their mobile apps to ensure that they provide a holistic mobile experience for their customers.

According to EY’s Global Fintech Adoption Index; 75% of consumers use a fintech service for money payments and transfers. 50% of consumers use an insurance fintech service. Most alarmingly for traditional financial service providers like banks and insurers is that according to the report over 68% of consumers would be in favor of using a non-financial services company for financial services.

Awareness of fintech solutions and services is extremely high - even amongst non-adopters. Banks that rely on corporate or SME banking services will find the need to transform their business model quickly because over 93% prefer fintech services over traditional financial services whenever possible.

“Most alarmingly for traditional financial service providers like banks and insurers is that according to the report over 68% of consumers would be in favor of using a non-financial services company for financial services.”

Innovation will be necessary to compete in this industry and it is not limited to providing banking services on the go. Insurance companies are being disrupted by innovators as well who are simplifying the process of obtaining an insurance policy which is commonly considered a challenging and confusing chore by users.

The following propositions are new to the insurance market and are being provided by non-financial service providers around innovative technologies:

- Insurance premium comparison sites

- App-only insurance

- Insurance-linked smart devices

Smarter Business Models Mean Smarter Investment in Technology

Choosing the right mix of technologies needed to provide a complete experience for your clients will need to be based on their needs and they should be built around a website robust enough to adapt to the various disruptive factors that may impact your business or customers’ needs.

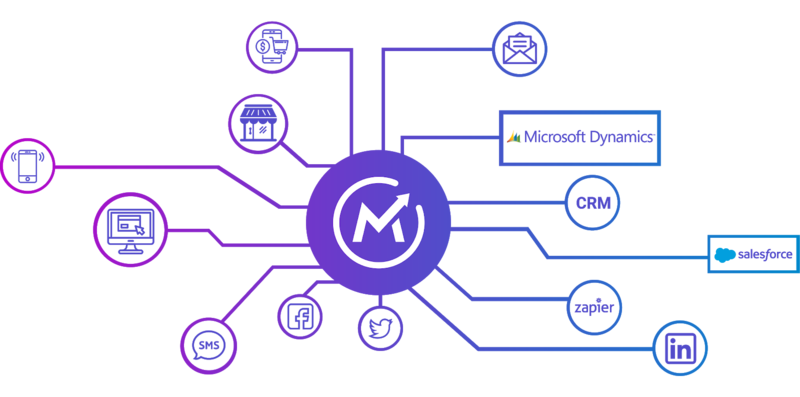

Your clients will interact with your business via numerous channels owned by you or otherwise - via social media, email, or mobile app. At the center of this network of channels and touchpoints, your website will be the most critical.

It is more than likely that your current or legacy CMS hindered your ability to continuously upgrade your website and user experience.

CMS Buyers Guide

Need help choosing the ideal CMS?

Download our free CMS Buyers Guide!

Choose a powerful CMS that enables your bank or insurance business to:

1. Launch Multiple Websites

Multisite functionality is an ideal technology and solution for major enterprises operating in the financial sector.

For example, major banks with an extensive network of partners and programs such as Al Rajhi in Saudi Arabia; would want to create multiple websites for their various initiatives in a bid to create a unique user experience for each website yet consistent with their corporate branding.

Enable your marketing, content creation, and IT department to build, launch and manage thousands of websites under your brand. quicker to market, from one centralized Drupal CMS. This allows your websites to share security, consistent branding, and a seamless content publishing and moderation process. Acquia Cloud Site Factory empowers your designers and gives your digital marketing team creative freedom to meet market demand and accelerate the pace of your business.

2. Automate Personalized Experiences

In today's customer-first world; a generic one size fits all experience is not good enough.

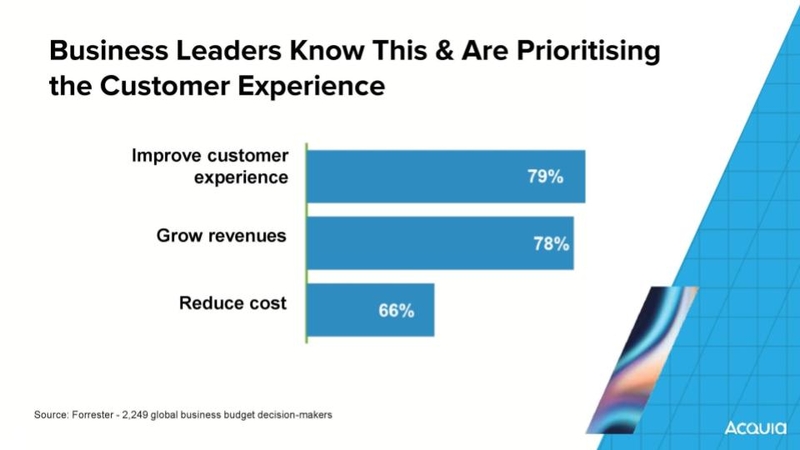

Personalization has become a key factor in creating rich and dynamic user experiences. The financial services industry is an industry that competes heavily in providing the best customer service and experience, which only means that personalization should be at the forefront of all your strategies that focus on creating lasting relationships with your clients.

Your customers are looking to your financial service business for security and enablement. You should be able to help and assist your website visitors to identify their problems and offer them solutions. Our partners Acquia provide a powerful personalization tool called Acquia Lift that allows marketers to execute profile management, segmentation, and personalization activities in a single place and launch them across a network of websites.

Your CMS must be flexible enough to allow for key integrations with relevant systems, software, and new technologies that might become critical to your business model.

Download: Digital Insurance Customer Journey

3. Deliver Superior Marketing Campaigns and Results in Minutes

Integrating your CMS with the ideal marketing automation tool enables your marketing team to create dynamic marketing messages and communicate more effectively. This is highly recommended as email marketing and messaging, in particular, are primary forms of preferred communication between financial operators and their clients.

Marketing automation offers a strategic competitive advantage for smaller banks or financial service providers such as insurance agencies with limited resources and marketing staff. They can target segments with dynamic marketing messages just as effectively as a major enterprise with vast resources dedicated to marketing efforts.

Delivering highly customized marketing campaigns across all channels plays a significant role in enabling your business to generate more qualified leads and retain your existing clients at a lower cost.

Download: Vardot Marketing Automation Datasheet

The Biggest Challenge

The main challenge that remains is that banks and other traditional financial service providers need to change their mindset regarding digital transformation. Digital transformation needs to start at the top and be at the forefront of every new product or service development program for financial service providers.

Your customers' expectations are rapidly changing and they expect you to align your value offering to their expectations. Is your business model able to deliver the needs of the digital consumer banking or digital insurance market?

Evolution in the financial services industry is forcing banks, insurers, investment solution providers, and even stock exchanges to reimagine their business models. It’s time to take action and start enabling your clients to maximize the benefit they expect to gain from your business.

Need Support?

Talk to our experts to explore how your website performance is impacting your business and identify solutions.

- Financial Sector

- Financial Services

- Drupal 8

- Drupal 9

- FinTech

- Banking

- Digital Insurance